We specialise in core functions of corporate treasurers and financial managers, such as, cash flow forecasting, cash & Liquidity Management, financial risk, banking relations, funding and refinancing, and capital structure advice. Our executive team built strong relations in the Portuguese market over the last 20 years. Our team of service professionals have a blend of skills in treasury management, debt advisory, raising capital for projects and transactions.

Centrus is an independent financial services group that believes in finance with purpose.

GR Finance & Treasury is the sole provider of titantreasury for Portuguese speaking countries. We provide expertise in treasury and accounting combined with seamless customer service that puts our teams at the heart of the technology solution.

Our core Corporate Offer delivered over web under titan cube reports (software as a service) offers reports and advice (if required) on the following topics:

We also address Private Investor needs on the following aspects:

We provide standard reports on data analytics and valuation/compliance of financial instruments:

We advise companies sourcing new capital for their investment plans or refinancing needs.

We cover debt capital markets, private equity markets and real estate finance.

On debt capital markets we partner with PKF Attest Debt Capital Markets to advise corporates and public institutions on their debt capital markets activities, the different DCM tools and instruments available to them, and help them access the wholesale funding market regularly and efficiently. Together with PKF Attest Debt Capital Markets we offer our clients a Market reference firm for Short-Term Commercial Paper with a dominant position in the Spanish CP market and a view to access wider European market via ECP programmes.

On real estate finance we have a partnership with “By Aleksandra Sasha”. This is a Real Estate -Design – Architecture – Development & Investment specialised brand for the design, architectural and business development of real estate with a worldwide network of investors and clients.

Credit risk, Liquidity risk, Financing, Investments, Private Placements, Cautions & Guarantees, Interest rate derivatives, Cash, Budget, Hedge efficiency, Commodity hedging, Foreign exchange, Currencies derivatives and more.

Key benefits:

titantreasury displays the global exposure on foreign exchange and interest rate risk and on the cash position and outstanding short and long-term financing and investments.

The solution enables the company’s senior management to evaluate opportunities while controlling risks, as well as managing financial strategies by integrating the treasury budget compared with the level of debt of the company.

titantreasury measures and allows treasurers to anticipate their financial risks by following covenants and controlling liquidity risks.

Risk Management essentials to help you save time,

human and financial resources.

Operation Workflow

Valuation & Postion Analysis

Estimated Budget & Cash-flow Forecast

Risk Analytics

Financial Data

Payment schedules and Accounting

Audit & Security

Expert Support

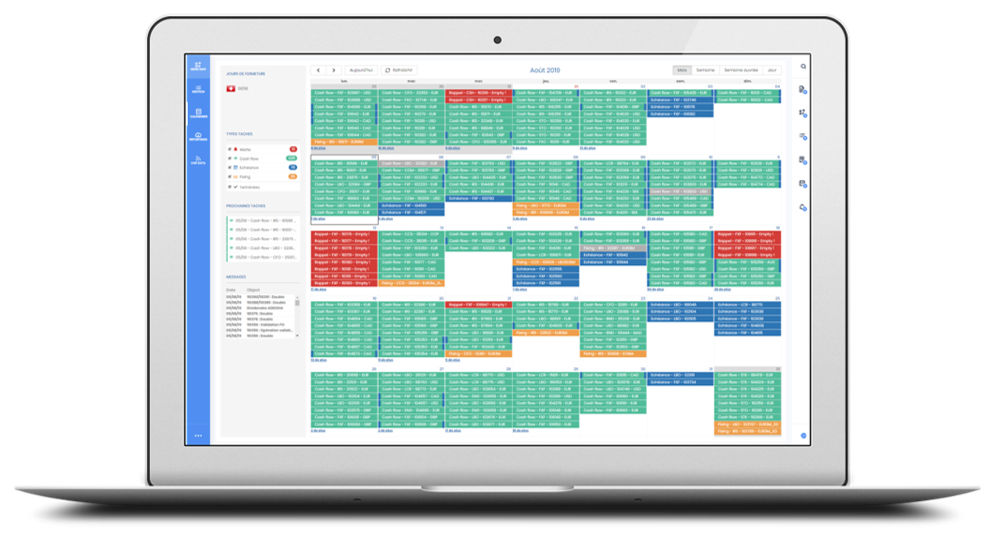

View your cash events in a calendar format showing upcoming events such as cashflow interest and capital payments, trade maturity and fixings.

Easily set task alerts that will show on your dashboards. Manage your workflow via specific designated tasks. Save time and be more efficient.

.png?width=200&height=200&name=user%20(5).png)

More than 30 years of experience in corporate finance, debt advisory and M&A. Projects across several sectors including banking, industrial, infrastructure and real estate.

Former Head of Transaction Advisory Services of EY Portugal, worked at Barclays Bank in London (corporate lending & securities) and Banco de Fomento in Portugal (capital markets).

MSc in Law at Lisbon Law School (thesis on capital requirements to cover market risk on trading book), degree in Economics at NOVA, Certificate in Capital Markets Foundations from UNC Kenan-Flager Business Scholl. Currently, PhD candidate on securities market law.

.png?width=200&height=200&name=user%20(5).png)

David has 7 years of experience in corporate finance and financial planning and controlling, with an extensive background in forecast & financial modelling and business valuation, in a variety of sectors.

Previously, he worked for 4 years in the Telecom sector in Brazil at Oi S.A., as a financial controller in the Planning and Financial Control division and TIM S.A., in the Treasury and Cash Management department.

David has a MBA from IBMEC and is graduated from Universidade do Estado de Rio de Janeiro (Economic engineering). Universidade Estacio de Sa (Business management).

This website and its content is copyright of 3V Finance (© 2014 – 2019) and GR Advisory (© 2020) (© 2014 – 2020)

titantreasury is a trademark of 3V Finance.