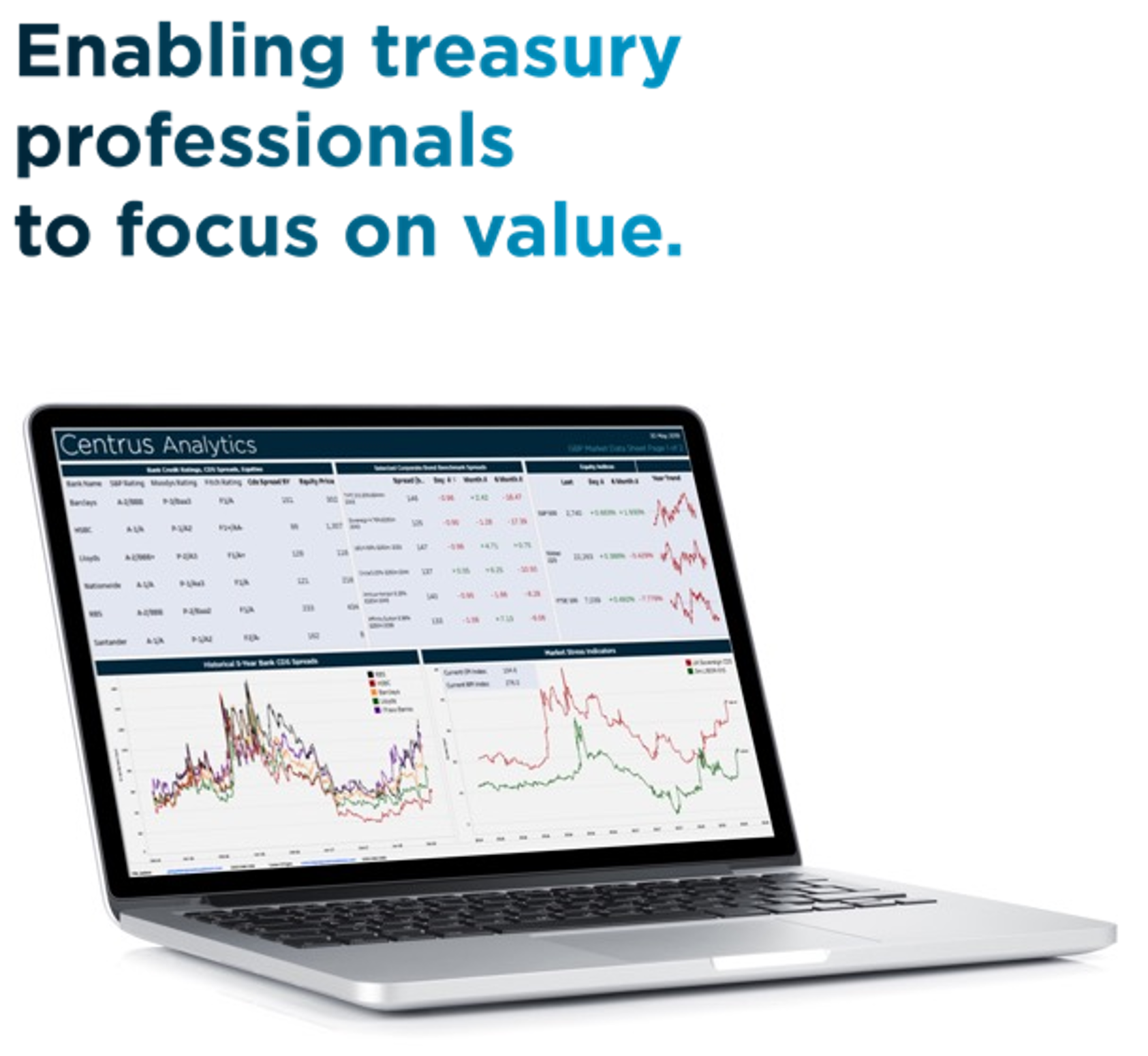

Centrus is an independent financial services group that believes in finance with purpose. We specialise in treasury advisory and analytics. Centrus Analytics provides leading solutions in systems, reporting and independent valuations to empower the Social Housing sector to focus on value rather than automatable tasks.

We have been collaborating with housing associations since 2012 and are proud to continue helping them to embrace technology in their treasury processes.

Centrus is an independent financial services group that believes in finance with purpose.

At Centrus we believe in putting people first. This means understanding the needs of finance and treasury professionals working in social housing in order to work as an extension of your treasury team.

Centrus is the sole UK provider of titantreasury and, on top of the extensive platform functionalities that help you save time and resources, we can provide you with expertise in treasury and accounting combined with seamless customer service and that puts the relationship with you and your team at the heart of the technology solution.

As companies are increasingly pressured from stringent accounting requirements, demanding derivatives regulation and greater volatility in underlying markets, so they look to receive more debt and derivative valuations from independent sources, rather than bank counterparties. Centrus Analytics support clients through this process to achieve consistently accurate valuations, using a sophisticated technology solution combined with debt and derivatives advisory expertise and access to high quality market data.

We have the systems capability to help you model your derivative portfolios and the technical expertise to use financial analytics to accurately measure Credit Valuation Adjustment (CVA) and Debit Valuation Adjustment (DVA) values.

Centrus Intelligent Business solution brings you a myriad of data sources into one place, so you can easily make intelligent decisions.

Centrus can help you to easily set up your own risk assessment views tailored to your needs, giving decision-makers and executives like you the ability to quickly identify and analyse risk for your particular business situation.

Our team believes in investing time into building an actionable data base, that guarantees data confidentiality, integrity and accessibility. On top of that, your customised data base is then hosted in the Cloud by a leading provider.

Credit risk, Liquidity risk, Financing, Investments, Private Placements, Cautions & Guarantees, Interest rate derivatives, Cash, Budget, Hedge efficiency, Commodity hedging, Foreign exchange, Currencies derivatives and more.

Key benefits:

titanTreasury displays the global exposure on foreign exchange and interest rate risk and on the cash position and outstanding short and long-term financing and investments.

The solution enables the company’s senior management to evaluate opportunities while controlling risks, as well as managing financial strategies by integrating the treasury budget compared with the level of debt of the company.

titanTreasury measures and allows treasurers to anticipate their financial risks by following covenants and controlling liquidity risks.

Risk Management essentials to help you save time,

human and financial resources.

Operation Workflow

Valuation & Postion Analysis

Estimated Budget & Cash-flow Forecast

Risk Analytics

Financial Data

Payment schedules and Accounting

Audit & Security

Expert Support

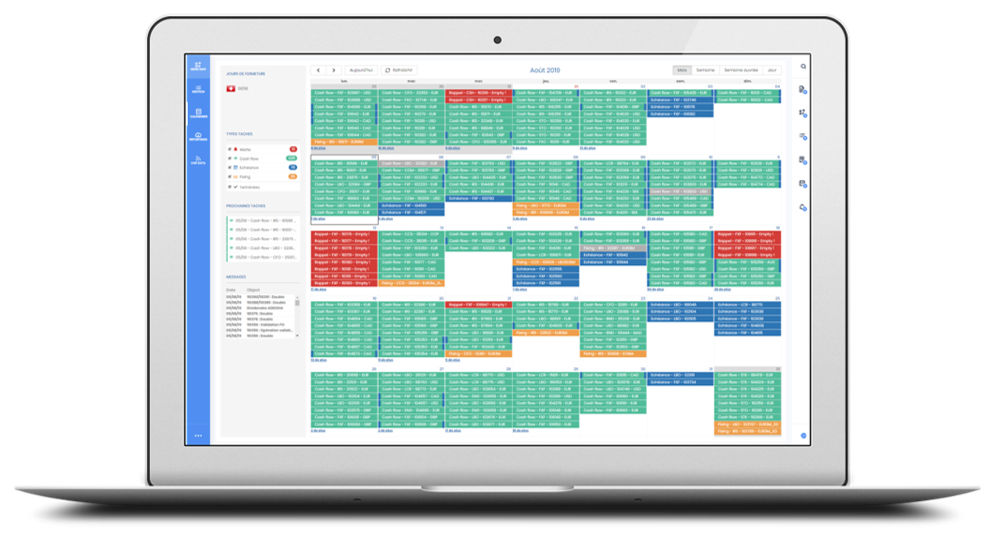

View your cash events in a calendar format showing upcoming events such as cashflow interest and capital payments, trade maturity and fixings.

Easily set task alerts that will show on your dashboards. Manage your workflow via specific designated tasks. Save time and be more efficient.

Gilles Bonlong

Gilles joined Centrus as a Senior Treasury and Risk Consultant and leads our titanTreasury implementation projects in the UK. Gilles was previously employed at Rentokil Initial plc where he was responsible for the reporting and financial disclosure requirements for the company. During his time at Rentokil, Gilles managed a major treasury system scoping, selection and implementation processes. He holds a BSc in Accounting & Finance from Newport University and is in the final stage of his ACT qualification.

T: +44 (0) 203 846 5704 - gilles.bonlong@centrusadvisors.com

To visit the Centrus website, please click here.

Terena Williams

Organised and self-motivated, following completion of her BSc in Accounting and Finance and successful internship at Centrus, Terena joined the Centrus Analytics team having demonstrated a natural aptitude for client relationship management that is supported by strong analytical capability for derivative systems and financial market mechanics.

This website and its content is copyright of 3V Finance and Centrus Corporate Finance Ltd (© 2024) and Centrus Financial Advisors Ltd (© 2019) and Centrus Advisors Ltd (© 2024)

All rights reserved. Centrus Analytics is a trademark of Centrus. Financial Advisors Ltd. titantreasury is a trademark of 3V Finance.